Did you check out our recent 2019 Hiring Insight in Finance and Accounting yet? We’ve got the research to prepare for your 2019 hiring initiatives. Go ahead and read it; we’ll be waiting here for you.

The accounting and finance sector has long been dominated by an older generation with little room for flexibility and a limited capacity for innovation. It’s an image that, coupled with the still-recent memory of the economic downturn, makes for an unappealing stereotype. As a result, most employers find it difficult to attract younger generations – an increasingly serious problem given the state of today’s market landscape.

47% of CFOs believe their teams are too shorthanded to meet future industry demands. Those demands include an estimated 773,800 new jobs added to the finance and accounting marketplace by 2026. But new jobs are only part of the problem; as Baby Boomers continue to retire in droves – and with Generation X being too small to replace them – hundreds of existing roles are suddenly vacant and a wealth of knowledge is in process of being lost.

So where are the Millennials to fill these roles? They are, after all, the largest generation in the US, and the vast majority have already entered the workforce.

Where Are the Millennials in Finance & Accounting Careers?

Research shows you’re more likely to find Millennial workers in tech than in finance and accounting. One recent study found that just 10% of over 4,000 surveyed young adults were interested in finance as a career option, down from 22% a decade ago. Even top MBA grads are increasingly choosing career paths outside of finance, which is a new and unsettling reality for employers who historically rely on fresh new talent to grow their F&A workforce.

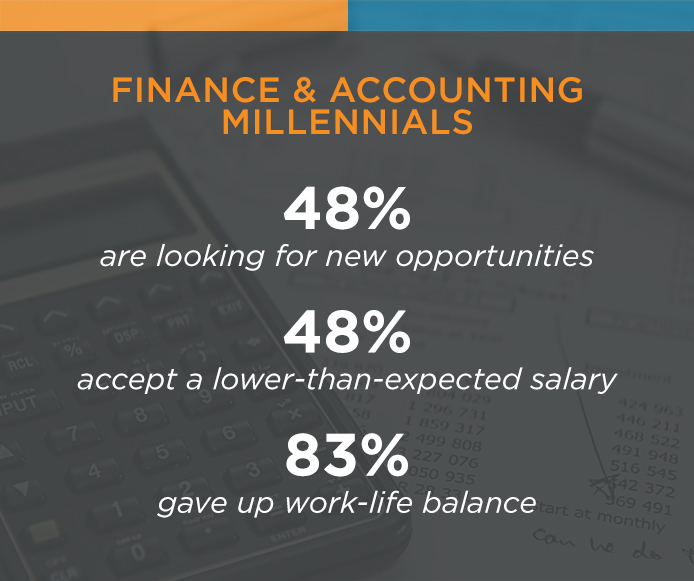

Of Millennials who already find themselves in the finance and accounting sector, a massive 48% are looking for new opportunities – and often in a completely different industry. Why the lack of loyalty? It’s mostly a result of compromise. Many of these workers graduated into a less-than-certain economy, leading them to accept roles that fell short of their initial expectations and desires. For example, 48% say they accepted a lower-than-expected salary, and an overwhelming 83% say they gave up work-life balance. These compromises perpetuate the negative stereotype of the finance and accounting workforce, which was already negatively impacted by the financial crisis of 2008.

Of Millennials who already find themselves in the finance and accounting sector, a massive 48% are looking for new opportunities – and often in a completely different industry. Why the lack of loyalty? It’s mostly a result of compromise. Many of these workers graduated into a less-than-certain economy, leading them to accept roles that fell short of their initial expectations and desires. For example, 48% say they accepted a lower-than-expected salary, and an overwhelming 83% say they gave up work-life balance. These compromises perpetuate the negative stereotype of the finance and accounting workforce, which was already negatively impacted by the financial crisis of 2008.

As a result, the Institute of Management Accountants reports that 62% of senior finance professionals say recruiting Millennials is the biggest challenge for their business. Meanwhile, almost half of all Millennials who are in finance and accounting stay at each job just 1-3 years, creating massive turnover. It goes without saying that this is a costly challenge, not only economically but also from a knowledge transfer perspective. And where positions sit empty for too long, the pressure falls on remaining workers, whose bandwidth is already tight and their morale decreasing.

In short, Millennials in finance and accounting careers are few and far between. Attracting andN retaining more of them is going to take major table stakes and careful strategy.

What Do Millennials Want in Their Career?

Employers of finance and accounting professionals must consider the generational differences of their workforce. Few Baby Boomer finance professionals worry about work-life balance, for example, as opposed to their Millennial counterparts.

But work-life balance is only a fraction of Millennial’s priorities in the workplace. A Deloitte study suggests that this generation is much more concerned with a company’s impact on the society and environment, capacity to create innovative ideas, commitment to job creation and career development, and emphasis on diversity and inclusion.

However, these same individuals report that their current employers are instead focused on generating profit, driving efficiency, and selling their products and services. To the Baby Boomer finance leader, these values make business sense; this is how a company grows, after all. But that growth can’t happen without a loyal, growing workforce, and that means paying attention to what Millennials want in their career.

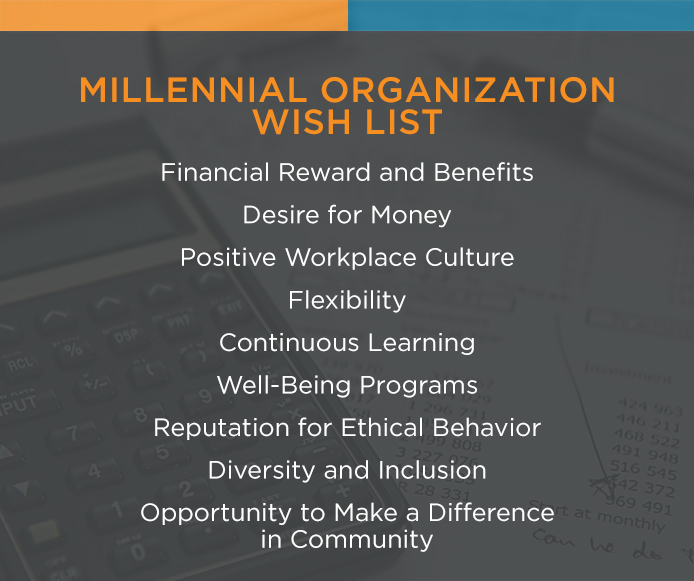

Beyond their core values, the Deloitte study reports that Millennials have a unique “wish list” when considering an organization to work for. At the top of that list is financial reward and benefits. As a generation that grew up watching their parents struggle with the realities of the economic recession, this desire makes sense – even if it seems at odds with their values in impact, innovation, and diversity. They are financially responsible and want to protect themselves against future downturns.

The desire for money is following closely by a positive workplace culture, flexibility, continuous learning, well-being programs, reputation for ethical behavior, diversity and inclusion, and, finally, the opportunity to make a difference in their community. This wish list belongs to Millennials in general, across industries, but in finance and accounting specifically, it’s clear that Millennials also value a defined career path. However, data from the Association of Chartered Certified Accountants reveals that only 26% of young workers see a clear career path in their current role.

It’s clear that many companies need to evaluate what they have to offer this growing generation.

Attracting Millennials to the Finance and Accounting Workforce

Redefining company values and reinvigorating your workplace culture to meet the demands of the Millennial generation is no small feat. It’s not as simple as writing bigger paychecks or establishing an “employee of the month” program (though these may be part of the overall strategy).

Redefining company values and reinvigorating your workplace culture to meet the demands of the Millennial generation is no small feat. It’s not as simple as writing bigger paychecks or establishing an “employee of the month” program (though these may be part of the overall strategy).

A good place to start, in alignment with Millennials’ “wish list,” is to assess how your workplace processes and workflows fit into the big picture, and find ways to enable greater flexibility accordingly. Look at other, similar ways to introduce more work-life balance and create a more positive culture.

Professional development programs and training opportunities are additional ways that organizations can proactively attract Millennials to their finance and accounting workforce. Initiatives like these do require that leaders are genuinely interested in the goals and challenges of their workers, checking in to receive (and give) frequent feedback and leveraging opportunities to mentor and coach young professionals. Millennials want to make a difference and understand the impact they are making in their roles; thus, nurturing a culture that can provide meaning is also key to retaining this generation of workers.

Promoting diversity and inclusiveness should also be top of mind for organizations trying to fill finance and accounting talent shortages. It’s encouraging to see that 85% of CEOs in the financial services sector are already promoting talent diversity and inclusiveness, with mentoring programs and leadership training among other strategies.

Finally, finance and accounting leaders should consider how these initiatives to attract Millennials fit in with other industry trends, such as digitalization and automation. While this younger generation is often considered the first “digital natives,” the influx of technology in the finance space shouldn’t overshadow their need to personally connect and collaborate. Ideally, AI-powered finance tools should simultaneously help to automate transactional accounting and finance tasks while generating actionable insights to inform business decisions – all while leaving more complex, strategic (and meaningful) work to human minds.

Recruiting Millennials in Finance and Accounting

At the end of the day, it’s imperative that organizations see past the status quo and acknowledge that the financial and accounting world is shifting. Creating the right culture and workplace to empower these younger generations is essential, but knowing where to find and recruit these professionals is also key. For example, 51% of employers say that getting employee referrals is the most successful practice in recruiting Millennials.

At Brightwing, we believe that a reimagined approach to recruiting is also indispensable. No longer can employers simply post a job and let their automated recruiting tools do the work. It’s about relationships, intuition, and experience. We’d love to share more insight about how we’re recruiting Millennials in today’s business landscape – chat with us today.