Did you check out our recent 2019 Hiring Insight in Finance and Accounting yet? We’ve got the research to prepare for your 2019 hiring initiatives. Go ahead and read it; we’ll be waiting here for you. The accounting and finance sector has long been dominated by an older generation with little room for flexibility…

Continue reading ...

You don’t have to be an accountant to do the math: The BLS reports that 5.5 million jobs in America are currently unfilled due to lack of talent. Meanwhile, they project a 10% increase in the number of finance and accounting occupations by 2026. It’s no surprise, then, that employers can expect 2019 to be…

Continue reading ...

- July 21, 2017

-

Accounting & Finance, Employers, Engineering, Hiring Best Practices, Human Resources, Information Technology, Manufacturing, Marketing, Operations, Operations, Talent Advisor

Recruiting is not merely a function of HR, it’s essential to the success of your organization. Without a well-defined strategy for recruiting talent, you run the risk of making inefficient and costly hiring decisions—up to $17,000 in lost productivity, compromised work quality, and turnover. To ensure better hires, you need a targeted recruiting strategy…

Continue reading ...

The art and science of recruiting with purpose goes beyond matching a skill set to a job requirement. It’s about understanding the position and its impact on the organization and industry—and finding the ideal candidate who aligns with the organization’s core values and the other employees. Brightwing’s 5 Tips for Purpose-Driven Recruiting…

Continue reading ...

Quitting your job is a big move that, if done right, may be beneficial to your career. However, make sure it is the right time and for the right reasons. With such a big change, it’s crucial that you are strategic when quitting your job, to position yourself to move forward in your career…

Continue reading ...

- August 11, 2016

-

Accounting & Finance, Career Growth, Engineering, Entry-Level, Human Resources, Information Technology, Interview Tips, Job Search, Job Seekers, Marketing, Operations

Negotiating a job offer begins the moment you start your job search. The key is to be prepared by researching similar positions in the industry. Doing your homework will help you make smarter, more reasonable decisions and establish a negotiation strategy. The most important factor in negotiating a job offer is confidence – confidence…

Continue reading ...

- August 25, 2015

-

Accounting & Finance, Brightwing News, Career Growth, Engineering, Entry-Level, Human Resources, Information Technology, Job Search, Marketing, Networking, Operations

One of our favorite times of the year is upon us – it’s career fair season! This year, Brightwing plans to attend 6 IT and/or Engineering career fairs. Cutting-edge, exclusive opportunities you can expect to see at the fairs include Software Development, Project Management, Big Data Analysis, Electrical/Mechanical Engineering, and more! To see a complete list of our…

Continue reading ...

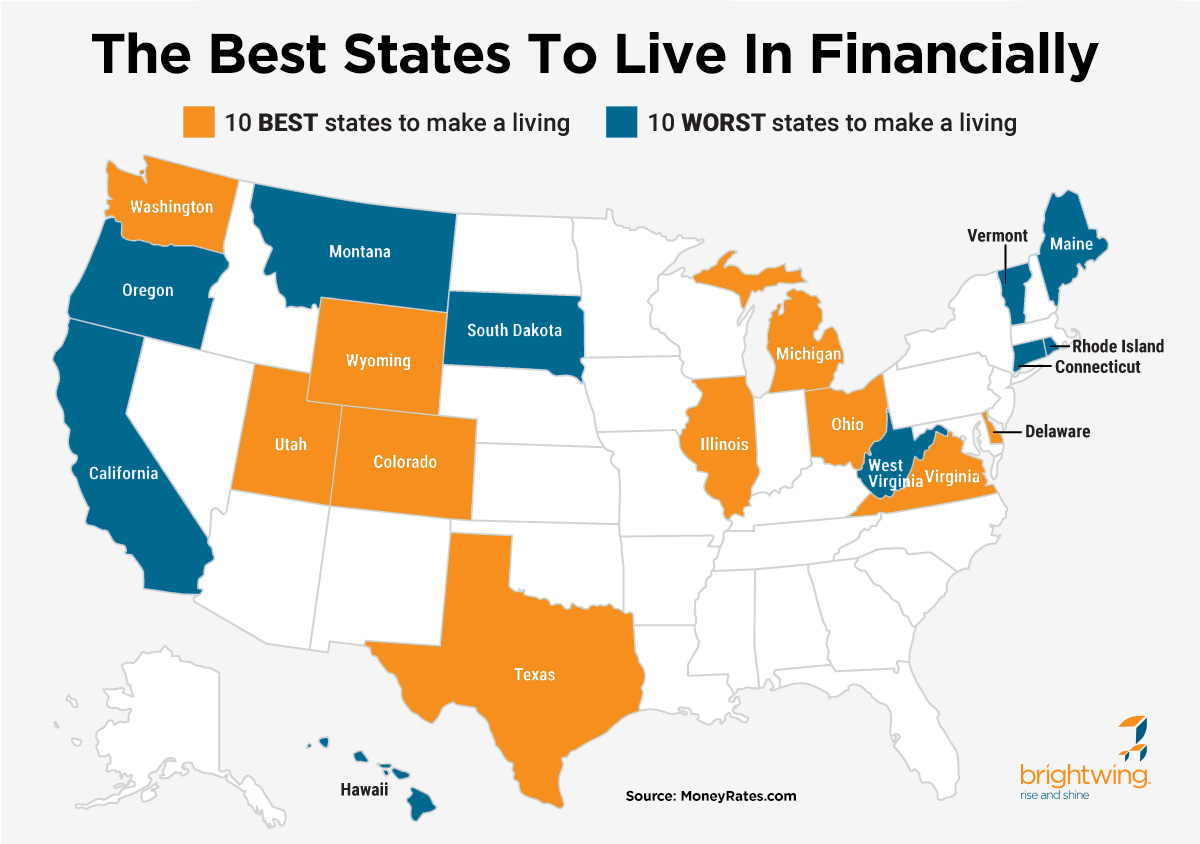

Ranking the best states to live in can often lead to drawn out, subjective conclusions. It’s been done before in many different ways, and everyone likes to see their state on top. But when it comes to the best states to live in financially, MoneyRates delivered with some of the best cut-and-dry data. 5 financial factors were evaluated to rank the…

Continue reading ...

Today’s world of talent acquisition or “recruiting” seems to have some very confusing measurements around what represents value. The market is trending towards more outsourced solutions: RPOs, MSPs, automated resume parsing and screening, as well as off shoring some, or all of the initial contact with potential candidates. This trend seems to represent a quicker delivery (in…

Continue reading ...

- September 13, 2012

-

Accounting & Finance, Career Growth, Engineering, Entry-Level, Human Resources, Information Technology, Job Search, Manufacturing, Marketing, Operations

What do you do when you’re starting out? What do you do when you’re switching industries, or rejoining the workforce? While every situation is different, many companies are looking for people with experience. Here are a few ideas for students, professionals switching industries or those rejoining the workforce: Students leaving the nest If you are…

Continue reading ...